Building inspections & drug testing from experienced inspectors

Buy With Confidence!

Insurance Reports

Insurers are fast becoming risk adverse and seeking to minimise and mitigate their losses in an everchanging environment that includes:

- Earthquakes

- Climate change

- Global warming

- Tsunamis threats

- Liquefaction

- Slippage

- Flood events

To do this many insurers are either increasing their premiums, excesses, (or both), with many now requiring insurance reports detailing risk assessments so that they can more accurately assess the risk they are underwriting.

We specialise in this area and may be able to assist you in reducing the costs you pay your insurance company by providing a detailed and accurate summary assessment of risk as part of our Insurance Risk Report.

NZ House Surveys has customers that have saved literally thousands of dollars annually on their insurance premiums by insurers being better able to accurately forecast and assess risk.

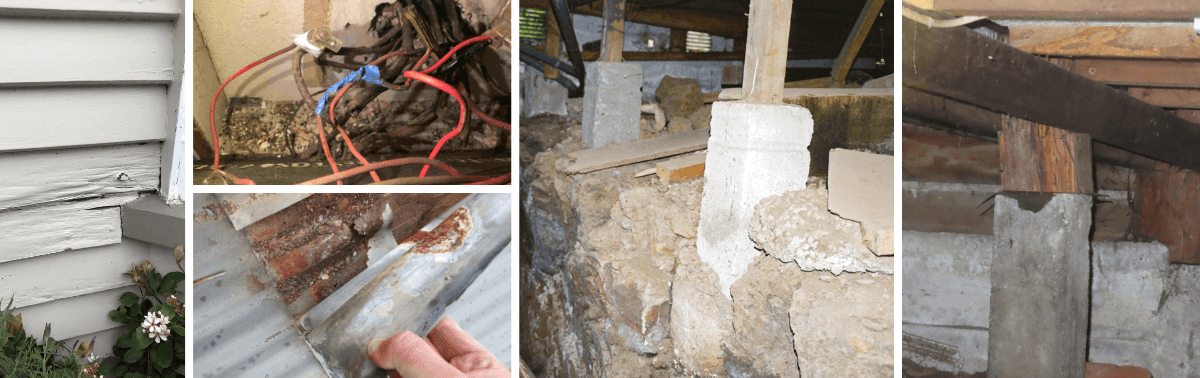

For houses that predate 1955 many insurers now require a report for new insurance with questions being asked such as:

- Has the property been rewired – is older TRS or VIR wiring still in place?

- Is scrim present within the dwelling?

- Has the property been re-piled, and if not what is the general condition of the piles?

- What sort of plumbing is present, has it been replumbed, and is Dux Qest present?

- Roofing condition report – state of the material and whether it has been or needs reroofing?

These questions and more including an Earthquake Report can be included within your Report and savings can be made immediately by way of premium reductions – either annually or by monthly deduction.

So what are you waiting for – call us today or fill in the email inquiry form and one of our friendly inspectors will be in touch quickly to save you money!